tax deferred exchange definition

A 1031 Exchange is the swap of qualified like-kind real estate for other qualified like-kind real estate structured pursuant to 1031 of the Internal Revenue Code. If you would like to find out about the reverse exchange process or the tax deferred exchange process contact one of our experts today.

The company also offers strategic advisory asset management.

. 1031 Tax Deferred Exchanges allow you to keep 100 of your money equity working for you. A 1031 tax-deferred exchange is exchanging one property for another without being taxed on the gain. A deferred exchange may help you capture tax benefits offered by a 1031 exchange.

The definition is vague. Over the long term consistent and proper use of this strategy can pay. This makes these transactions more ideal for individuals with a higher net worth.

The tax deferred exchange as defined in 1031 of the Internal Revenue Code offers taxpayers one of the last great opportunities to build wealth and save taxes. The 1031 exchange is in effect a tax deferral methodology whereby an investor sells one or several relinquished properties for one. Ultimately the 1031 exchange is a completely legal tax-deferred strategy that any taxpayer in the United States can use.

The theory behind Section 1031 is that when a property owner has reinvested the sale. In fact many investors secure two or three properties in case the first falls through. The 1031 tax-deferred exchange is a method of temporarily avoiding capital gains taxes on the sale of an investment or business property.

A deferred or reverse exchange thereby disqualifying the transaction from Section 1031 deferral of gain. By completing an exchange the Taxpayer Exchanger can dispose of investment or business-use assets acquire Replacement Property and defer the tax that would ordinarily be due upon the sale. A like-kind exchange is a tax-deferred transaction allowing for the disposal of an asset and the acquisition of another similar asset.

The company also offers strategic advisory asset management. The Reverse Exchange is structured primarily with Revenue Procedure 2000-37 in mind. Not taxed until sometime in the future a tax-deferred savings plan.

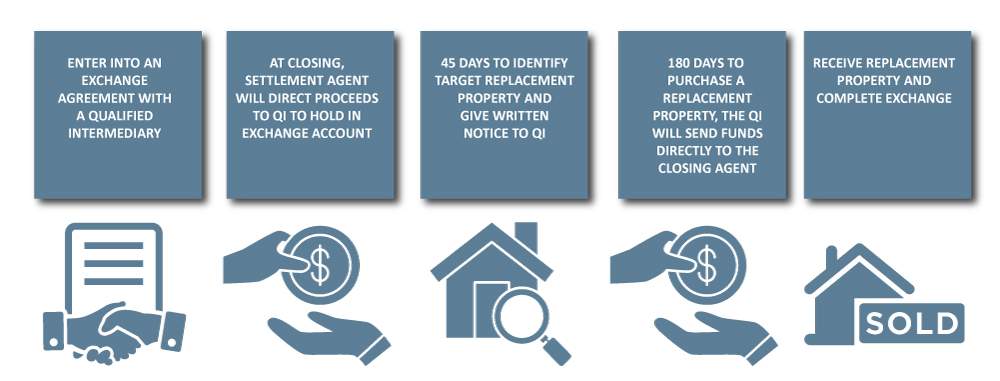

It may take time to find and secure the right like-kind property. Learn what a deferred 1031 exchange is and why its important. A tax-deferred exchange is a method by which a property owner trades one or more relinquished properties for one or more replacement properties of like-kind while deferring the payment of federal income taxes and some state taxes on the transaction.

Tax-deferred status refers to investment earningssuch as interest dividends or capital gainsthat accumulate tax-free until the investor takes constructive receipt of the profits. A 1031 exchange allows you to defer capital gains tax thus freeing more capital for investment in the replacement property. A tax-deferred exchange is a method by which a property owner trades one or more relinquished properties for one or more replacement properties of like-kind while deferring the payment of federal income taxes and some state taxes on the transaction.

Simply put you increase buying power while deferring taxes. This can be done as many times as youd like but there are some rules to follow so that your gains arent taxed. We want to help your 1031 exchange transaction go as smoothly as possible.

Under Section 1031 of the United States Internal Revenue Code 26 USC. A tax-deferred exchange also referred to as a like-kind exchange a 1031 exchange a threeparty exchange or a Starker exchange may provide a way for you to take that 26000 apply it to the rental house purchase and delay the payment of the capital gains tax until you sell the new property. A like-kind exchange is a tax-deferred transaction allowing for the disposal of an asset and the acquisition of another similar asset.

In 1979 this treatment was expanded by the courts to include non-simultaneous sale and purchase of real estate a. Its important to keep in mind though that a 1031 exchange may require a comparatively high minimum investment and holding time. 1031 a taxpayer may defer recognition of capital gains and related federal income tax liability on the exchange of certain types of property a process known as a 1031 exchange.

Reverse Exchange Definition. A tax-deferred exchange in which one asset is exchanged for a similar asset of the same nature character or class. The gain may be taxable in the current year.

Those taxes could run as high as 15 to 30 when state and federal taxes are combined. In a tax-deferred exchange under Internal Revenue Code Section 1031 the sellertaxpayer is prohibited from receiving the proceeds from the sale of the relinquished property. In real estate a 1031 exchange is a swap of one investment property for another that allows capital gains taxes to be deferred.

The termwhich gets its name from Internal Revenue Code IRC. The 1031 Exchange allows you to sell one or more appreciated rental or investment real estate or personal property relinquished property and defer the payment of your capital gain and depreciation recapture taxes by acquiring one or more like-kind properties replacement property. This property exchange takes its name from Section 1031 of the Internal Revenue Code.

Although the numbers and the properties differ this is the type of question. State federal and depreciation recapture taxes are deferred and the tax savings are invested in the new property. Like-kind property When two properties belong to the same category or type theyre called like-kind.

Capital Employed Accounting And Finance Financial Management Shopify Business

What Is A 1031 Tax Deferred Exchange Kiplinger

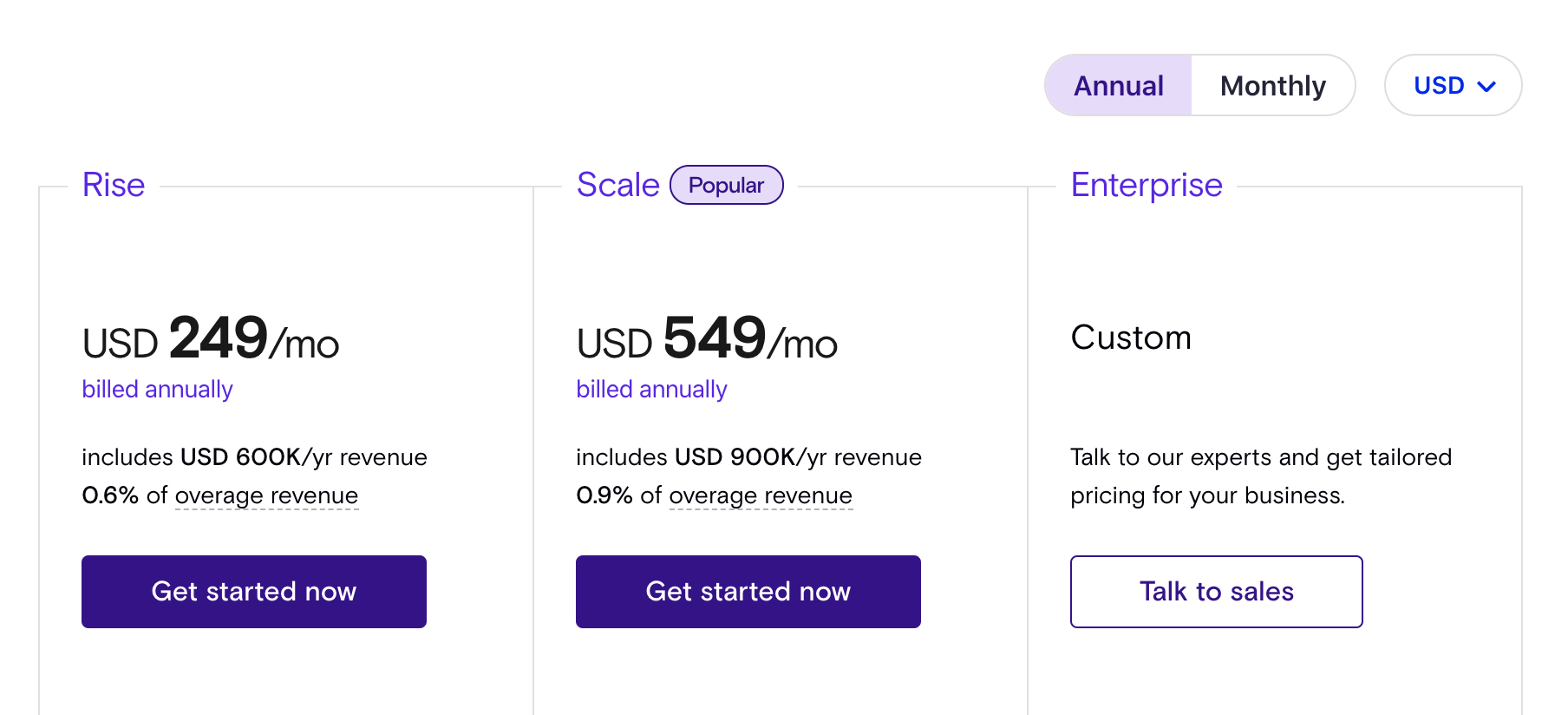

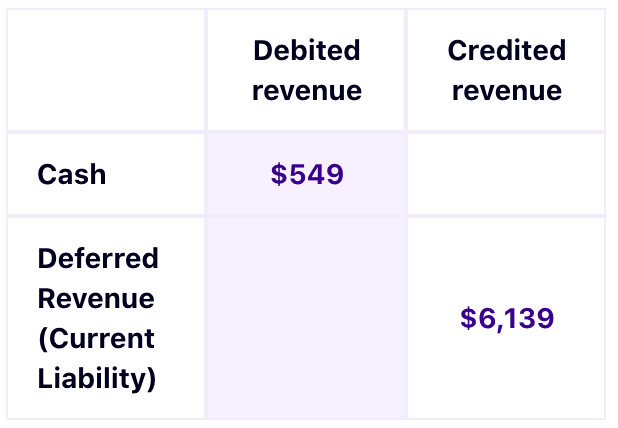

What Is Deferred Revenue Learn How It Works Chargebee

What Is Deferred Revenue Learn How It Works Chargebee

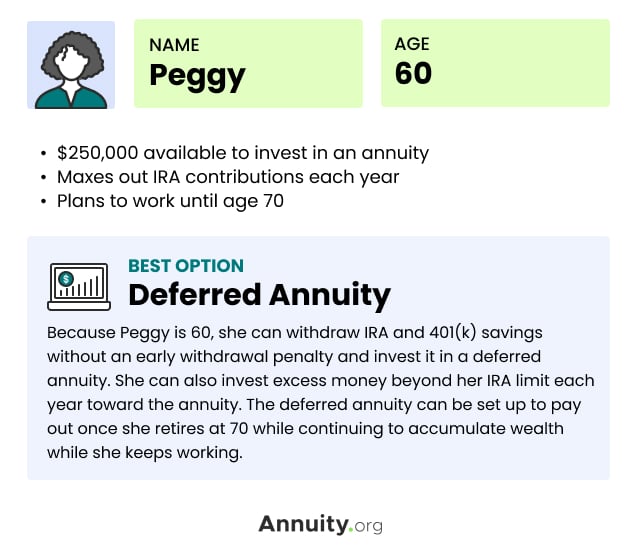

What Is A Deferred Annuity Pros Cons Of Deferred Annuities

Deferred Revenue Definition And Spa Treatment

Investopedia 100 Top Financial Advisors Of 2019 Early Retirement Career Change Retirement Budget

6 Steps To Understanding 1031 Exchange Rules Stessa

What Is A 1031 Exchange Asset Preservation Inc

Tax Deferral How Do Tax Deferred Products Work

Deferred Tax Liability Definition

Pin On Printable Real Estate Forms 2014

What Is The Benefit Of Tax Deferred Growth Great American Insurance

Are You Eligible For A 1031 Exchange

Like Kind Exchanges Of Real Property Journal Of Accountancy